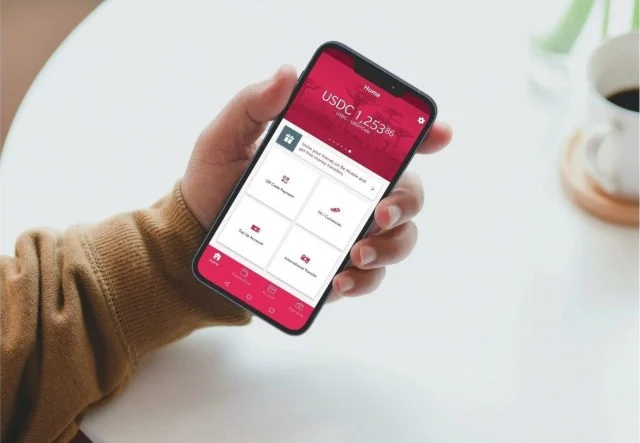

Be Mobile Africa aims to accelerate financial inclusion throughout Africa by delivering innovative digital banking solutions to serve these users.

Be Mobile Africa, a Canadian neobank, has launched officially in South Africa, targeting the unbanked and underbanked with low to no-fee banking products through its app. According to Oxford Business School, an estimated 23.5% of the population is unbanked, with R12 billion (USD 1.04 billion) in cash believed to be held outside of banks.

Be Mobile Africa: Driving financial inclusion

Be Mobile Africa aims to accelerate financial inclusion throughout Africa by delivering innovative digital banking solutions to serve users that have been overlooked by traditional banks. “We are incredibly excited to launch our services in South Africa. This is an important market for us, and we believe there is great potential for growth,” said CEO and Co-Founder Dr. Cédric Jeannot.

By opening an account, customers can hold, send and receive funds in multiple currencies, including USD and EUR, send money abroad in seconds and earn 5% interest per annum in USD and EUR with Be Mobile Africa’s savings offering. Added to this, customers can transfer and request money instantly and at no cost from anyone in the Be Mobile Africa network and exchange currencies with low FX fees.

With no monthly account fees, minimum balance requirements or dormant account fees, the company offers an attractive alternative for those overlooked by traditional banks. The neobank’s services are currently available in 30 African countries and plans to expand into additional markets in the future.

The launch of Be Mobile Africa follows the announcement of the 2nd annual Digital Finance Africa event on 22 September at The Maslow in Sandton, Johannesburg in South Africa. The forum wil be hosted by IT News Africa under the theme of ‘Bridging the gap between the future and the present through digital solutions’.

Digital payment solutions, such as PaySky’s services, are on the rise across the MENA region.

2 Comments

Pingback: Nedbank becomes first African bank to stake a claim in the Metaverse

Pingback: South Africa’s Fin acquires Thuthukani