Nedbank buys 100% of fintech iKhokha in an all‑cash deal of R1.65 bn, aiming to deepen support for small and medium‑sized enterprises through technology.

Nedbank Acquires iKhokha to Accelerate SME Growth

Nedbank Group (site) has announced that it had entered into a binding agreement to acquire 100% of fintech innovator iKhokha in an all cash deal for approximately R1.65 bn (subject to certain adjustments upon conclusion). The announcement states that the transaction “is subject to customary regulatory approvals and is expected to conclude in the coming months”.

According to the announcement, iKhokha (site) will become a wholly owned subsidiary of Nedbank, while importantly maintaining its own brand and leadership team.

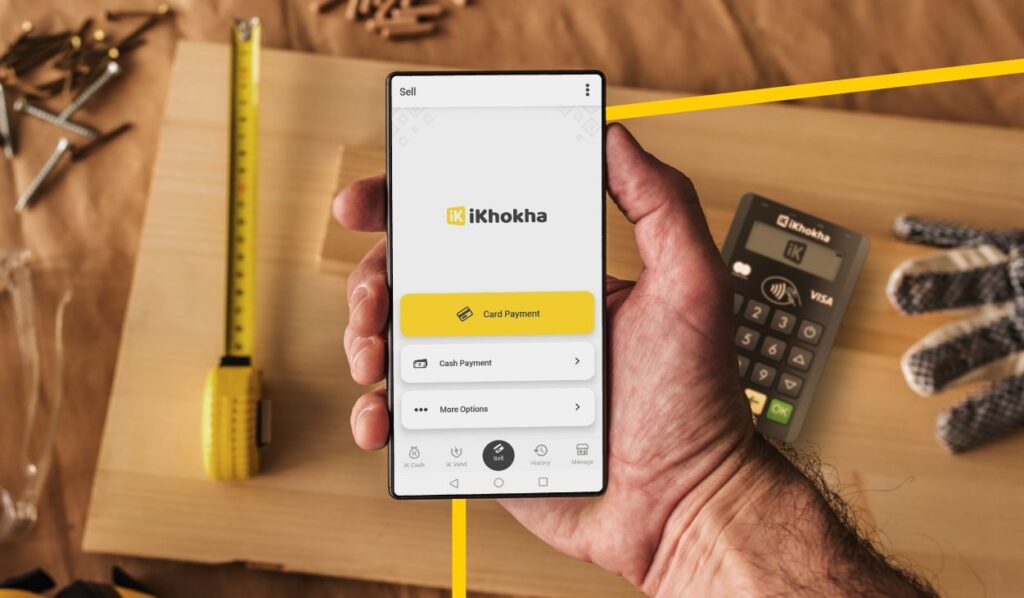

iKhokha, founded by Matt Putman, Ramsay Daly, and Clive Putman, is a South African fintech that delivers card machines, digital payment solutions, and business tools tailored for SMEs. The company has supported hundreds of thousands of entrepreneurs by widening access to affordable financial services. To date, iKhokha processes over R20 bn in digital payments annually and has extended more than R3 bn in working capital to the SME sector.

Strategic Rationale: Combining Innovation with Banking Expertise

Ciko Thomas, Group Managing Executive for Personal and Private Banking at Nedbank, commented: “This acquisition is a natural evolution of our existing relationship with iKhokha and we are incredibly excited to welcome iKhokha to our Nedbank family,” adding that “by combining their innovative technology with our deep banking experience, we will provide small business clients with the best‑in‑class tools they need to thrive.”

Similarly, Jason Quinn, Chief Executive of Nedbank Group, said: “iKhokha’s mission and technology align perfectly with our vision for digital transformation in the SME sector. Together, we will unlock new opportunities for growth and financial inclusion in South Africa and potentially abroad.”

Investor Exit Reflects Confidence in iKhokha’s Growth

The transaction also represents a successful exit for iKhokha’s long‑standing investors, Apis Partners, Crossfin Holdings, and the International Finance Corporation (IFC).

Dean Sparrow, CEO of Crossfin Holdings, remarked: “we are extremely proud of what has been achieved by the iKhokha team to date and the fact that we have found a great home for the business, its people and the SME market it services.”

iKhokha Leadership Endorses the Move

Matt Putman, CEO and co‑founder of iKhokha, said: “Joining forces with Nedbank gives us the platform to scale our impact, further accelerate product innovation, and unlock new value for our merchants. … There is great alignment across both leadership teams … and we believe our combined strengths will result in a truly differentiating and highly competitive value proposition for SMEs in market. It also opens the door for us to explore expansion into other strategic markets on the continent.”

The acquisition includes a comprehensive management lock‑in to ensure managerial continuity and alignment with long‑term growth objectives.

For more stories of business and trade in Africa, visit our dedicated archives.