DMCC’s latest report reveals that the UAE held its position as a leading hub, while South Africa and Nigeria ranked in top 10 global hubs.

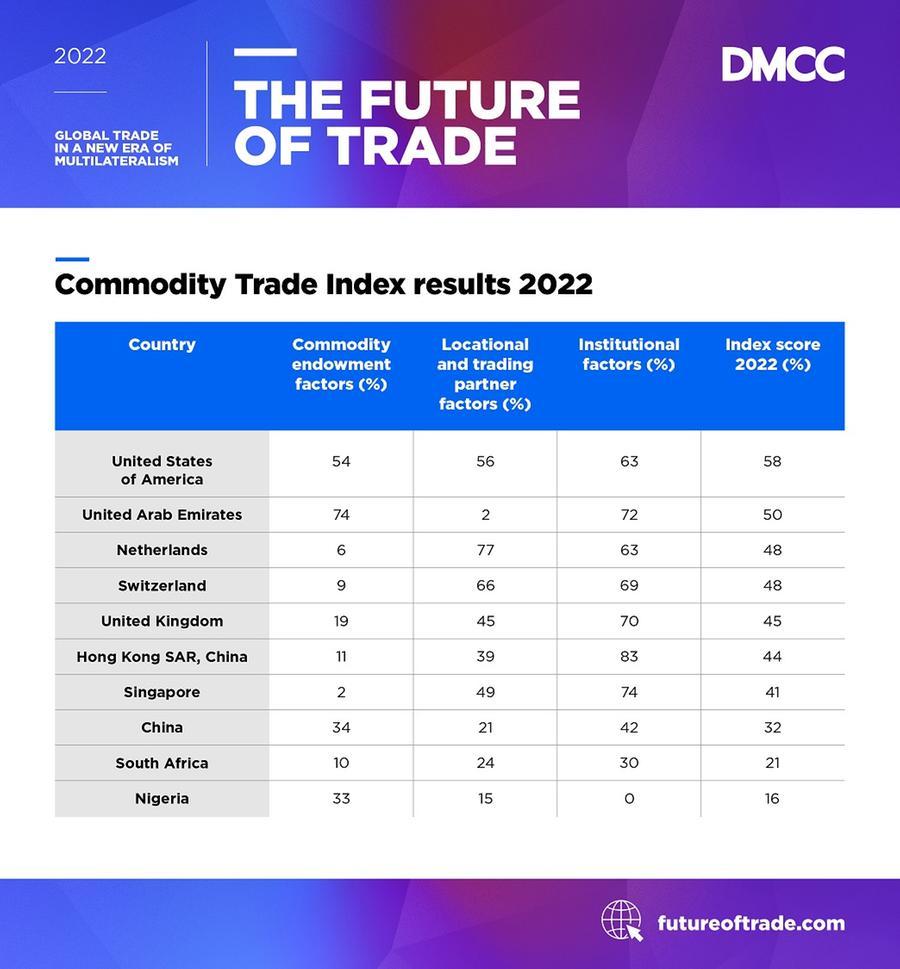

According to the Commodity Trade Index presented in Dubai Multi Commodities Centre’s (DMCC) latest Future of Trade 2022 report, the UAE ranked as the second most important international commodity hub, while South Africa and Nigeria ranked ninth and tenth respectively.

DMCC ranking criteria

DMCC’s Commodity Trade Index ranks the position ten key trading hubs with regard to their impact on global trade. The report combines global viewpoints based on research, data and interviews with business leaders and trade experts. The latest edition studies the changing nature of global trade, with a focus on geopolitics, technology and global economic trends and how they will impact the future of trade, including trade growth, supply chains, trade finance, infrastructure and sustainability. The report also provides tangible recommendations for trade growth for governments, policymakers and businesses.

The countries are ranked according to an analysis of ten indicators across three major areas, location and trading partners, commodity endowments and institutional factors:

Locational and trading partner factors

Headquarter locations of major commodities trading houses

Proximity to markets (based on commodity export data)

Commodity trade partner tariffs on primary goods

Commodity endowment factors

Tons of oil exported annually

Hub’s share of global commodity trade for coffee, grains, sugar, gold, diamonds, soya bean, tea, cotton, silver, animals and animal products and plastic

Natural resource rents as a share of GDP

Institutional factors

Financial services infrastructure

Attractiveness of the tax regime

Strength of contract enforcement

Logistics performance

Notable rankings

According to the latest report, the United States maintained the top spot, scoring 58% overall. The UAE stood in second place with a total score of 50%. The UAE recorded the highest score for commodity endowment factors due to its large oil reserves and ranked third overall for institutional factors, due to its attractive tax regime and strong logistical performance.

The Netherlands entered the top three hubs for the first time, scoring 48%. South Africa ranked ninth, with a total score of 21%, with Nigeria rounding out the list in tenth with a score of 16%.S

The spread between the top and bottom hubs widened between 2020 and 2022 suggesting that the leading hubs have weathered the impact of the pandemic and Ukraine war more effectively than those lower on the list.

Feryal Ahmadi, Chief Operating Officer, DMCC, said, “Over the past few years, the commodities market has been heavily impacted by the pandemic and the associated supply chain issues. This has been compounded by additional macroeconomic factors such as heightened geopolitical tensions. The global economic environment remains challenging, however, the Commodity Trade Index proved that the UAE has firmly maintained its position as a world leading trade hub. Building on this momentum, DMCC will continue to prioritize increasing the ease of doing business and promoting the huge commercial potential that Dubai possesses.”

The report can be accessed here.

Among other deals in the pipeline, the Abu Dhabi Exports Office recently signed a deal to improve trade with ECOWAS states.

2 Comments

Pingback: Global ports: Dubai ranks fifth in 2022 shipping index

Pingback: Dubai Diamond Exchange announces trade of USD 19.8 billion in H1 2022